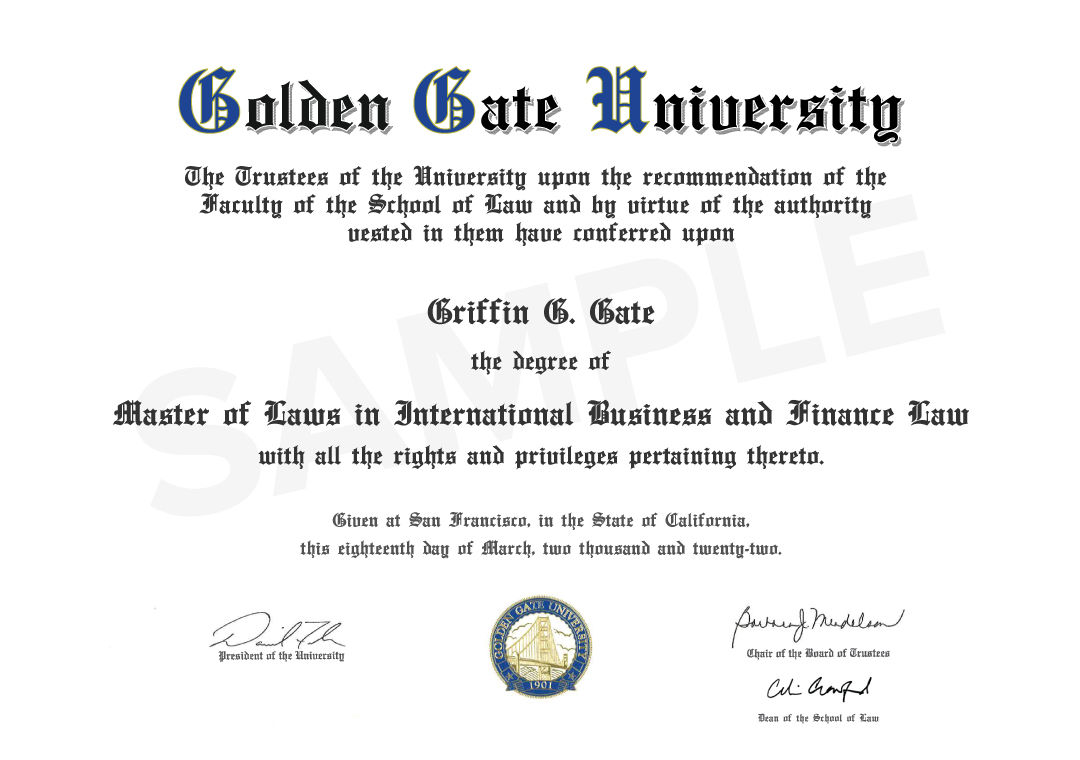

Master of Laws (LL.M.) - International Business and Finance Law

5 out of 6 learners get positive career growth

upGrad Results reviewed by Deloitte

Watch

INTRO VIDEO

In association with

U.S. Universities according to College Factual

Top 10%for working professionals by Washington Monthly

Ranked #1Online with optional on-campus immersion

Formatof Educational Excellence

120+ YearsProgram Duration

-- MonthsStart Date

Coming Soonfor 5,000 students

70% ScholarshipAccreditations and Associations

Overview

Key Highlights

#1 Country for Higher Education

Get a degree from the U.S., ranked #1 among countries with the best educational systems*. Earn the same U.S. Master's Degree we award on campus!

*Source: World Population Review, 2022

Who is this Program for

Minimum Eligibility

Job Opportunities

Top Subjects you will Learn

Syllabus

Best-in-class content by leading faculty and industry leaders in the form of videos, cases, and projects.

About the Program

WASC Accreditation & WES Recognition

GGU has been accredited by WASC Senior College and University Commission (WSCUC) since 1959 and it is WES recognized. WASC accredits universities in California and Hawaii, including Stanford, UC Berkeley, and others. WSCUC is nationally recognized by the US Department of Education and the Council for Higher Education Accreditation (CHEA).

Learn from Scholar Practitioners

GGU instructors are scholar practitioners with decades of senior level work experience in the San Francisco Bay Area, including major Silicon Valley and Fortune 500 companies.

On-campus Immersion

Engage in optional, interactive networking sessions with your program peers and experienced professionals for a more immersive GGU experience.

- Golden Gate University School of Law is an American law school accredited by the American Bar Association (ABA), the California State Bar, and Western Association of Schools and Colleges Senior College and University Commission (WSCUC). GGU Law is a member in good standing of the Association of American Law Schools.

Disclaimer

Explore our Learning Platform

How a US Law School Master’s Degree impacts your career?

The unique advantage of this LLM is that it is open to both law and non-law graduates and therefore caters to both in a practical setting, providing you the opportunity to specialize in the most sought after skills in the business world

Understanding law and business on a global scale is all the more important for those wishing to relocate and build their career in a different country.

LLM will also give you access to connect with people across the globe

By the end of this program, you would have built a network of strong professionals and like-minded individuals.

Instructors

Delaram Farzaneh

Learn like you’re right there in San Francisco

Watch David Fike (President, GGU), Brent White (Provost and Vice President of Academic Affairs, GGU), and Phalgun Kompalli (Co-founder, upGrad) talk about the collaboration that makes it possible.

User Review

Régis Akakpo, LLM 2022

Syllabus

Recommended: 15+ learning content hours per week + 10-12 library & research hours per week

Principles Of International Law In Business Environments

- This course covers key principles of international law applicable to emerging innovations in a business environment and international commercial arbitration.

International Business Transactions And Commercial Contracts

- This course covers the governance of international business transactions and global investments including international secured finance under select international instruments.

Technology, Business & Law

- This course covers the challenges in international business posed by digital innovation and the efforts to regulate the digital economy.

Comparative Business Association Law

- This course provides a comparative overview of business associations in emerging markets and economically developing countries, emphasizing civil law systems.

International Trade Law

- This course covers the emerging challenges the WTO treaty mandates for international trade relations and the WTO dispute settlement system.

International Investment Law

- This course covers international investment law and the protection of international capital movements against sovereign risk imposed by adverse government action.

Comparative And International Issues In Intellectual Property Law

- This course covers different legal regimes that regulate different intellectual property rights and also covers implications in intellectual property disputes.

Dissertation

- The submission of a dissertation between 5,000 to 6,000 words is mandated for the successful completion of the degree.

Note:

The upGrad Advantage

Career Services

- Access to upGrad’s career portal

- 1:1 mentorship session

- Access to 300+ job openings

- Resume building tool

- Industry specific interview preparation

- Just-in-time interviews

Learning Support

- Receive unparalleled guidance from industry mentors, teaching assistants, and graders.

- Receive one-on-one feedback on submissions and personalised feedback on improvement.

- Student Support available all day for your convenience (24*7).

- For urgent queries, use the call back option on the platform.

Doubt Resolution

- Timely doubt resolution by industry experts and peers.

- 100% expert verified responses to ensure quality learning.

- Personalised expert feedback on assignments and projects.

- Regular live sessions by experts to clarify concept-related doubts.

Admission Process

There are 3 simple steps in the Admission Process which is detailed below:

Step 1

Submit Application

Complete your application, providing work experience and educational background. The admissions committee will review your application, including all required documentation.

Step 2

Apply for Scholarship

Submit your Statement of Purpose for the GGU program to which you are applying. Upon qualification, you will receive an Official Offer Letter confirming your admission to the course.

Step 3

Reserve Your Seat

Reserve your program spot by paying the required program deposit (typically INR 25,000) in full by the date specified in your offer letter. Start your educational journey.

Scholarships Offered by GGU and upGrad

Program Fees: Approximately $6000(Post Scholarship) with EMI options

Empowering the students of tomorrow

Golden Gate University Alumni Work At

Refer someone and Earn upto INR 50,000 Cashback/Vouchers, on every successful enrollment!

Your friend also gets an instant scholarship/free course!

Frequently Asked Questions

Course Eligibility

Who is this program for?

Working professionals who are looking to learn International Business and Finance Law as part of their leadership positions or lawyers who are looking to upskill and earn a Master's Degree.

What is the minimum eligibility for this program?

Bachelor's Degree in any specialization

How do I become eligible for the scholarship? What is the application process?

The scholarship is rolled out based on the academic and professional achievements. Once the application form is submitted with these details, the admission committee reviews the same. If you are admitted into the program, the scholarship that you are eligible for will be mentioned on the offer letter. Please note that admission is provisional until successful verification of supporting documents and completing the payment formalities.

Payment

Will I be able to avail EMI Options of my course fee even after receiving scholarships?

Yes, 70% scholarship available for 5,000 students along with EMI options are available.

How much do I pay to block my seat?

You need to pay INR 25,000 to block your seat.

Refund Policy/Financials

What is the refund policy for this program?

- You may request a refund for the Program at any time before the Cohort Commencement Date by visiting https://www.upgrad.com/ and submitting your refund form via the "My Application" section under your profile. A processing fee of Rs. 10,000 will be charged. Please note that once the Program commences, no refund request will be considered, and any amount paid by the student will not be refunded.

- Requests for refund must be sent via e-mail in the prescribed Refund Request Form. The refund will be processed within 30 working days of the commencement of the program. For refund and deferral policies please refer to this link.

No Cost Credit Card EMI FAQ's

0% EMI with Finance partners /Credit card option availability will vary program wise.

1. Which banks allow using 0% Credit card EMI or Credit card EMI?

No cost EMI is available on credit cards from all major banks (American Express, Bank of Baroda, HDFC Bank, ICICI Bank, IndusInd Bank, Kotak Mahindra Bank, RBL Bank, Standard Chartered, Axis Bank, Yes Bank, State Bank of India, CITIBANK and HSBC).

2. Is there any minimum transaction limit ?

Yes. 50000 is the minimum.

3. Standard Chartered Bank offers 18 or 24 months No Cost EMI ?

No. ONLY 12 months is available irrespective of the Program enrolled.

4. Will I have to pay any extra amount for EMI transaction?

If you are availing 0% credit card EMI, upGrad will not charge any processing fees or down payment for these transactions. Your bank may levy GST or other taxes on the interest component of the EMI.

5. Are there any fees or down payment?

Certain banks charge nominal processing fees between INR 99 - 500 on 0% Credit Card EMI transaction. If charged, will be billed in the first repayment installment.

6. Can I use my International credit card for 0% credit EMI or Credit Card EMI?

Only the Indian bank credit cards can be used. But you can pay the amount using the Credit card option in one shot / part payments, and later you can convert into EMI from your respective bank. The tenures and interest charged will depend on your bank. upGrad will not charge any processing fees or down payment for these transactions, this will be purely between you and your bank.

7. Are there any charges in case I opt for cancellation/refund from the course after paying balance with no cost EMI ?

Yes, there will be additional charges to the extent of interest paid by the upGrad to the bank, you will be refunded only Principal amount, i.e. the amount actually deducted/blocked from your card. This deduction will be in addition to the amount mentioned in the refund policy shared with your offer letter.

8. Can I Pay Using Multiple Credit Cards ?

Multiple cards can be used to complete the payments using Part payment option make sure to inform the learner, minimum transaction is INR 50000 to opt for 0% CC EMI E.g. Amount to be paid: 150000. I can pay using 2 Credit cards. Yes, Example :

HDFC Card – Part payment – INR 100000

ICICI Card – Part payment – INR 50000

9. How can I opt for Credit card EMI if my bank is not listed in the 0% Credit card EMI or Credit card EMI?

You can pay the amount using the Credit card option in one shot / part payments, and later you can convert into EMI from your respective bank. The tenures and interest charged will depend on your bank. upGrad will not charge any processing fees or down payment for these transactions.

10. Why is the entire amount blocked on my credit card?

Initially your bank will block the entire amount from your available purchase limit and from your next billing cycle, you will be charged the EMI amount. As you start paying your EMI, your credit limit will be released accordingly. For example, if you have made a payment of ₹100000 on 6-months EMI and your credit limit is ₹200,000 then initially your bank will block your credit limit by ₹100000. After payment of your first month EMI of Rs.15000, the blocked amount will come down to ₹85000.

11. Why is interest getting charged on No Cost EMI?

Your bank will charge you interest. However, this interest charge has been provided to you as an upfront discount at the time of your payment, effectively giving you the benefit of a No cost EMI. The total amount paid during the entire EMI tenure to the bank will be equal to the amount to be paid to upGrad.

Eg. Amount payable to upGrad: INR 405000

Let's say Amount deducted at the time of transaction: INR 379850 (Principal amount) Bank charges interest of 12-15% per annum on INR 379850

[Note: Interest factor is reducing rate and not Flat rate]

EMI AMOUNT = INR 33750 x 12 = INR 405000

Effectively, you have taken loan on 379,850 instead of 405,000